Why American Battery Technology Company’s (ABAT) Stock Is Surging

The stock of American Battery Technology Company (ABAT) has recently seen a significant increase, surging 12.24%. Investors and analysts have started paying close attention to this development, speculating on the factors driving this upward momentum. This article examines the key reasons behind ABAT’s stock increase, what it means for investors, and the long-term outlook of the company.

Understanding American Battery Technology Company (ABAT)

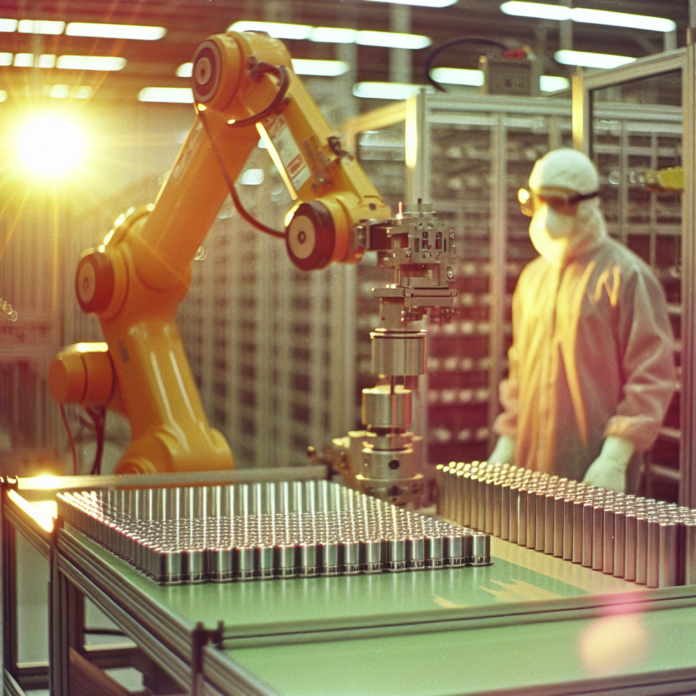

American Battery Technology Company is a leader in lithium-ion battery recycling and manufacturing. It focuses on sustainable and domestic battery material production to support the growing demand for electric vehicles (EVs) and renewable energy storage. The company aims to provide a closed-loop supply chain for critical battery materials, reducing reliance on foreign sources.

Why ABAT Is Important to the EV Industry

The electric vehicle industry is expanding rapidly, creating an increasing demand for lithium, nickel, cobalt, and other essential materials for battery production. ABAT’s innovative approach supports domestic battery supply while minimizing environmental impact. The company’s commitment to advanced recycling techniques and extraction methods positions it as a key player in the EV battery space.

Key Factors Behind ABAT’s Stock Surge

The recent surge in ABAT’s stock price is driven by multiple fundamental factors, including strategic business moves, market trends, and investor confidence.

1. Increased Demand for Battery Materials

The growing interest in electric vehicles and energy storage solutions has led to an increased need for sustainable and efficient battery production. With government incentives and global efforts to reduce carbon emissions, ABAT benefits from a favorable market environment. This rising demand has likely contributed to the stock uptick.

2. Advancements in Battery Recycling Technology

One of ABAT’s main strengths lies in its proprietary recycling technology. The company has been developing innovative processes to extract valuable materials from used batteries, reducing reliance on mining. Investors recognize the significance of this sustainable approach, improving the company’s long-term financial outlook and making ABAT an attractive investment opportunity.

3. Strong Investor Confidence

ABAT’s stock surge suggests strong investor confidence in the company’s future. As more companies and governments emphasize sustainable energy solutions, ABAT’s role in the battery supply chain becomes even more crucial. Investors may see ABAT as a long-term growth opportunity in the green energy sector.

4. Positive Industry Trends

The global push for electrification and sustainability is driving investment in battery technology and resource independence. Governments worldwide are implementing new policies to support clean energy, directly benefiting companies like ABAT. These macroeconomic factors further strengthen the company’s position in the market.

What This Means for Investors

The recent stock price increase indicates that investors are optimistic about ABAT’s potential. However, before making investment decisions, it’s essential to assess both the short-term and long-term outlook of the company.

1. Potential for Long-Term Growth

ABAT is well-positioned to capitalize on the growing demand for EV batteries. Its innovative recycling technology and commitment to securing a sustainable supply of raw materials provide a strong foundation for long-term success. Investors looking for exposure to the clean energy sector may find ABAT a compelling option.

2. Market Volatility Considerations

Despite the recent stock increase, it’s important to remember that the market can be volatile. Companies in emerging industries like battery technology can experience fluctuations in stock value based on various external factors, including regulatory changes, competition, and economic conditions.

3. Evaluating the Competitive Landscape

ABAT operates in a competitive industry with several established players, including Tesla, Albemarle, and QuantumScape. While ABAT’s unique approach to battery recycling sets it apart, investors should monitor industry trends and competitor activities to assess ABAT’s market position.

Conclusion: ABAT’s Bright Future

American Battery Technology Company’s recent stock surge reflects growing investor optimism about its role in the EV battery value chain. The company’s focus on sustainable battery manufacturing and recycling technologies aligns with global efforts to achieve cleaner energy solutions. While market volatility remains a factor, ABAT’s innovative business model and industry relevance make it an intriguing investment opportunity.

For investors interested in the clean energy sector, ABAT presents a compelling case for long-term growth, provided they carefully assess market trends and associated risks. With strong fundamentals and increasing demand for sustainable battery technologies, ABAT could be poised for continued success.